Page 23 - Seafarers---_Pension_Fund_Annual_Report_2020_s

P. 23

Annual Report of the Board

Seafarers’ Pension Fund 2020 Annual Report

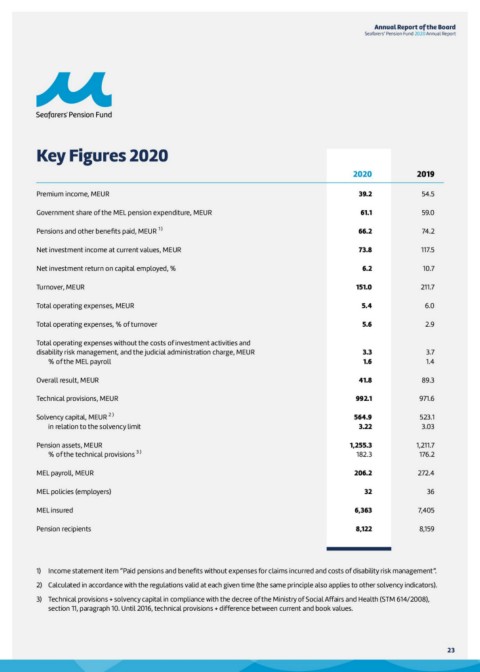

Key Figures 2020 2020 2019

39.2 54.5

61.1 59.0

Premium income, MEUR 66.2 74.2

Government share of the MEL pension expenditure, MEUR 73.8 117.5

Pensions and other benefits paid, MEUR 1 ) 6.2 10.7

Net investment income at current values, MEUR 151.0 211.7

Net investment return on capital employed, % 5.4 6.0

Turnover, MEUR 5.6 2.9

Total operating expenses, MEUR

Total operating expenses, % of turnover 3.3 3.7

Total operating expenses without the costs of investment activities and 1.6 1.4

disability risk management, and the judicial administration charge, MEUR 41.8 89.3

% of the MEL payroll 992.1 971.6

Overall result, MEUR 564.9 523.1

Technical provisions, MEUR 3.22 3.03

Solvency capital, MEUR 2 ) 1,255.3 1,211.7

in relation to the solvency limit 182.3 176.2

Pension assets, MEUR 206.2 272.4

% of the technical provisions 3 ) 32 36

MEL payroll, MEUR 6,363 7,405

MEL policies (employers) 8,122 8,159

MEL insured

Pension recipients

1) Income statement item “Paid pensions and benefits without expenses for claims incurred and costs of disability risk management”.

2) Calculated in accordance with the regulations valid at each given time (the same principle also applies to other solvency indicators).

3) Technical provisions + solvency capital in compliance with the decree of the Ministry of Social Affairs and Health (STM 614/2008),

section 11, paragraph 10. Until 2016, technical provisions + difference between current and book values.

2233