Page 12 - Seafarers_Pension_Fund_Annual_Report_2022

P. 12

Annual Report of the Board

Seafarers’ Pension Fund 2022 Annual Report

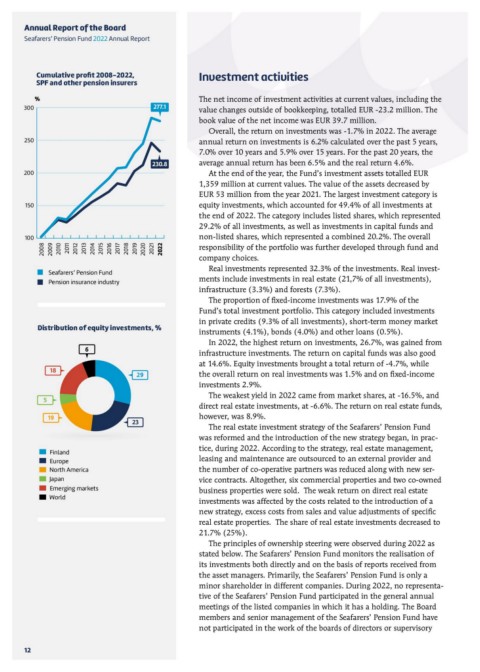

Cumulative profit 2008-2022, 277.1 Investment activities

SPF and other pension insurers

The net income of investment activities at current values, including the

% value changes outside of bookkeeping, totalled EUR -23.2 million. The

300 book value of the net income was EUR 39.7 million.

250 Overall, the return on investments was -1.7% in 2022. The average

annual return on investments is 6.2% calculated over the past 5 years,

230.8 7.0% over 10 years and 5.9% over 15 years. For the past 20 years, the

200 average annual return has been 6.5% and the real return 4.6%.

150 At the end of the year, the Fund’s investment assets totalled EUR

1,359 million at current values. The value of the assets decreased by

100 EUR 53 million from the year 2021. The largest investment category is

equity investments, which accounted for 49.4% of all investments at

2008 the end of 2022. The category includes listed shares, which represented

2009 29.2% of all investments, as well as investments in capital funds and

2010 non-listed shares, which represented a combined 20.2%. The overall

2011 responsibility of the portfolio was further developed through fund and

2012 company choices.

2013

2014 Real investments represented 32.3% of the investments. Real invest-

2015 ments include investments in real estate (21,7% of all investments),

2016 infrastructure (3.3%) and forests (7.3%).

2017

2018 The proportion of fixed-income investments was 17.9% of the

2019 Fund’s total investment portfolio. This category included investments

2020 in private credits (9.3% of all investments), short-term money market

2021 instruments (4.1%), bonds (4.0%) and other loans (0.5%).

2022

In 2022, the highest return on investments, 26.7%, was gained from

Seafarers’ Pension Fund infrastructure investments. The return on capital funds was also good

Pension insurance industry at 14.6%. Equity investments brought a total return of -4.7%, while

the overall return on real investments was 1.5% and on fixed-income

Distribution of equity investments, % investments 2.9%.

6 The weakest yield in 2022 came from market shares, at -16.5%, and

direct real estate investments, at -6.6%. The return on real estate funds,

18 29 however, was 8.9%.

5 The real estate investment strategy of the Seafarers’ Pension Fund

was reformed and the introduction of the new strategy began, in prac-

19 23 tice, during 2022. According to the strategy, real estate management,

leasing and maintenance are outsourced to an external provider and

Finland the number of co-operative partners was reduced along with new ser-

Europe vice contracts. Altogether, six commercial properties and two co-owned

North America business properties were sold. The weak return on direct real estate

Japan investments was affected by the costs related to the introduction of a

Emerging markets new strategy, excess costs from sales and value adjustments of specific

World real estate properties. The share of real estate investments decreased to

21.7% (25%).

The principles of ownership steering were observed during 2022 as

stated below. The Seafarers’ Pension Fund monitors the realisation of

its investments both directly and on the basis of reports received from

the asset managers. Primarily, the Seafarers’ Pension Fund is only a

minor shareholder in different companies. During 2022, no representa-

tive of the Seafarers’ Pension Fund participated in the general annual

meetings of the listed companies in which it has a holding. The Board

members and senior management of the Seafarers’ Pension Fund have

not participated in the work of the boards of directors or supervisory

12