Page 16 - Seafarers_Pension_Fund_Annual_Report_2022

P. 16

Annual Report of the Board Responsibility

Seafarers’ Pension Fund 2022 Annual Report The Seafarers’ Pension Fund seeks to operate responsibly in terms of

the ESG (Environmental, Social and Governance) factors. Of the UN

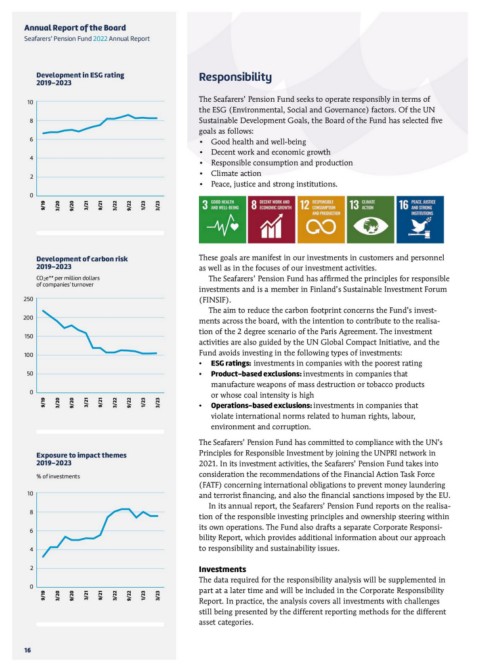

Development in ESG rating Sustainable Development Goals, the Board of the Fund has selected five

2019–2023 goals as follows:

• Good health and well-being

10 • Decent work and economic growth

8 • Responsible consumption and production

6 • Climate action

4 • Peace, justice and strong institutions.

2

0

9/19

3/20

9/20

3/21

9/21

3/22

9/22

1/23

3/23

9/19 Development of carbon risk These goals are manifest in our investments in customers and personnel

3/202019–2023 as well as in the focuses of our investment activities.

9/20

3/21CO2e** per million dollars The Seafarers’ Pension Fund has affirmed the principles for responsible

9/21of companies' turnover investments and is a member in Finland’s Sustainable Investment Forum

3/22250 (FINSIF).

9/22200

1/23150 The aim to reduce the carbon footprint concerns the Fund’s invest-

3/23100ments across the board, with the intention to contribute to the realisa-

50 tion of the 2 degree scenario of the Paris Agreement. The investment

0 activities are also guided by the UN Global Compact Initiative, and the

Fund avoids investing in the following types of investments:

Exposure to impact themes • ESG ratings: investments in companies with the poorest rating

2019–2023 • Product-based exclusions: investments in companies that

% of investments manufacture weapons of mass destruction or tobacco products

10 or whose coal intensity is high

8 • Operations-based exclusions: investments in companies that

6 violate international norms related to human rights, labour,

4 environment and corruption.

2

0 The Seafarers’ Pension Fund has committed to compliance with the UN’s

Principles for Responsible Investment by joining the UNPRI network in

16 2021. In its investment activities, the Seafarers’ Pension Fund takes into

9/19 consideration the recommendations of the Financial Action Task Force

3/20 (FATF) concerning international obligations to prevent money laundering

9/20 and terrorist financing, and also the financial sanctions imposed by the EU.

3/21

9/21 In its annual report, the Seafarers’ Pension Fund reports on the realisa-

3/22 tion of the responsible investing principles and ownership steering within

9/22 its own operations. The Fund also drafts a separate Corporate Responsi-

1/23 bility Report, which provides additional information about our approach

3/23 to responsibility and sustainability issues.

Investments

The data required for the responsibility analysis will be supplemented in

part at a later time and will be included in the Corporate Responsibility

Report. In practice, the analysis covers all investments with challenges

still being presented by the different reporting methods for the different

asset categories.