Page 12 - Seafarers---_Pension_Fund_Annual_Report_2020_s

P. 12

Annual Report of the Board Technical Provisions

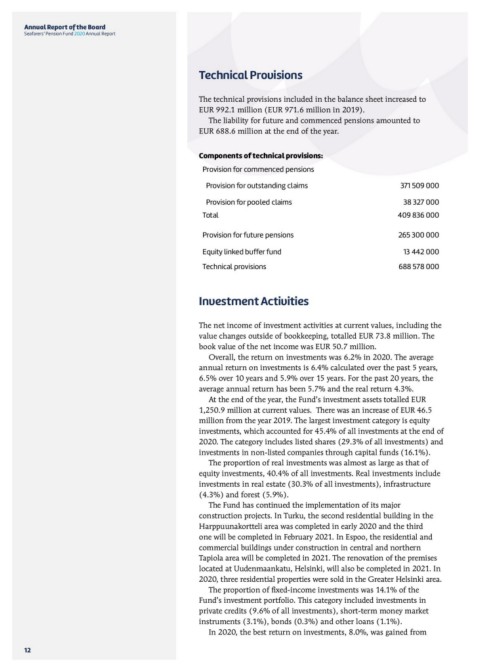

Seafarers’ Pension Fund 2020 Annual Report The technical provisions included in the balance sheet increased to

EUR 992.1 million (EUR 971.6 million in 2019).

12

The liability for future and commenced pensions amounted to

EUR 688.6 million at the end of the year.

Components of technical provisions: 371 509 000

Provision for commenced pensions 38 327 000

Provision for outstanding claims 409 836 000

Provision for pooled claims

Total 265 300 000

13 442 000

Provision for future pensions

Equity linked buffer fund 688 578 000

Technical provisions

Investment Activities

The net income of investment activities at current values, including the

value changes outside of bookkeeping, totalled EUR 73.8 million. The

book value of the net income was EUR 50.7 million.

Overall, the return on investments was 6.2% in 2020. The average

annual return on investments is 6.4% calculated over the past 5 years,

6.5% over 10 years and 5.9% over 15 years. For the past 20 years, the

average annual return has been 5.7% and the real return 4.3%.

At the end of the year, the Fund’s investment assets totalled EUR

1,250.9 million at current values. There was an increase of EUR 46.5

million from the year 2019. The largest investment category is equity

investments, which accounted for 45.4% of all investments at the end of

2020. The category includes listed shares (29.3% of all investments) and

investments in non-listed companies through capital funds (16.1%).

The proportion of real investments was almost as large as that of

equity investments, 40.4% of all investments. Real investments include

investments in real estate (30.3% of all investments), infrastructure

(4.3%) and forest (5.9%).

The Fund has continued the implementation of its major

construction projects. In Turku, the second residential building in the

Harppuunakortteli area was completed in early 2020 and the third

one will be completed in February 2021. In Espoo, the residential and

commercial buildings under construction in central and northern

Tapiola area will be completed in 2021. The renovation of the premises

located at Uudenmaankatu, Helsinki, will also be completed in 2021. In

2020, three residential properties were sold in the Greater Helsinki area.

The proportion of fixed-income investments was 14.1% of the

Fund’s investment portfolio. This category included investments in

private credits (9.6% of all investments), short-term money market

instruments (3.1%), bonds (0.3%) and other loans (1.1%).

In 2020, the best return on investments, 8.0%, was gained from