Page 16 - Seafarers---_Pension_Fund_Annual_Report_2020_s

P. 16

Annual Report of the Board

Seafarers’ Pension Fund 2020 Annual Report

Listed investments

The responsibility analysis includes liquid investments (excl. money

market instruments) whose market value totals EUR 371.0 million

(99% equity investments). Of these, foreign fund investments (15

investments) total EUR 270.6 million and direct domestic equity

investments (26 investments) total EUR 100.4 million.

For the listed liquid investments, the ESG ratings are at a high level.

The MSCI ESG rating is 6.4/10 (Level A), and the Sustainanalytics ESG

rating is 3.9/5. In the investment activities, particular attention has

been paid to the responsibility of funds within their reference group.

For example, in 2020, the emerging market index fund was replaced by

active funds with an emphasis on the ESG factors.

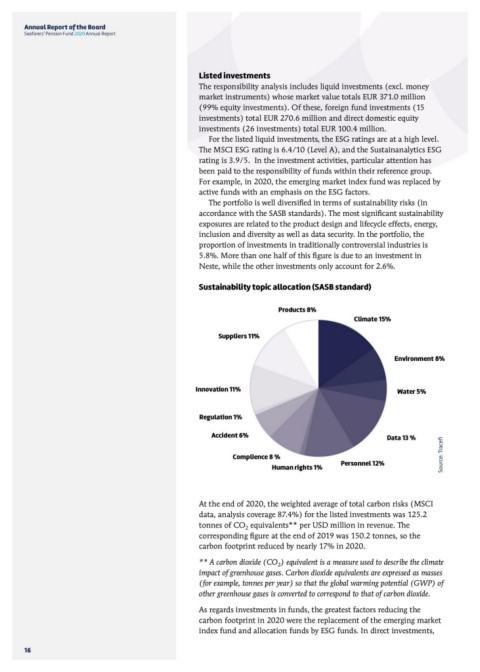

The portfolio is well diversified in terms of sustainability risks (in

accordance with the SASB standards). The most significant sustainability

exposures are related to the product design and lifecycle effects, energy,

inclusion and diversity as well as data security. In the portfolio, the

proportion of investments in traditionally controversial industries is

5.8%. More than one half of this figure is due to an investment in

Neste, while the other investments only account for 2.6%.

Sustainability topic allocation (SASB standard)

Source: Tracefi

At the end of 2020, the weighted average of total carbon risks (MSCI

data, analysis coverage 87.4%) for the listed investments was 125.2

tonnes of CO2 equivalents** per USD million in revenue. The

corresponding figure at the end of 2019 was 150.2 tonnes, so the

carbon footprint reduced by nearly 17% in 2020.

** A carbon dioxide (CO2) equivalent is a measure used to describe the climate

impact of greenhouse gases. Carbon dioxide equivalents are expressed as masses

(for example, tonnes per year) so that the global warming potential (GWP) of

other greenhouse gases is converted to correspond to that of carbon dioxide.

As regards investments in funds, the greatest factors reducing the

carbon footprint in 2020 were the replacement of the emerging market

index fund and allocation funds by ESG funds. In direct investments,

16