Page 6 - Seafarers---_Pension_Fund_Annual_Report_2021

P. 6

Annual Report of the Board

Seafarers’ Pension Fund 2021 Annual Report

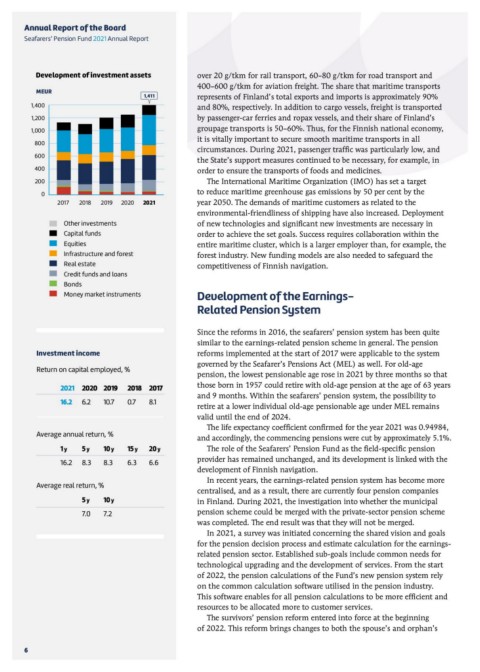

Development of investment assets over 20 g/tkm for rail transport, 60–80 g/tkm for road transport and

400–600 g/tkm for aviation freight. The share that maritime transports

MEUR 2018 1,411 represents of Finland’s total exports and imports is approximately 90%

2019 2020 2021 and 80%, respectively. In addition to cargo vessels, freight is transported

1,400 by passenger-car ferries and ropax vessels, and their share of Finland’s

1,200 groupage transports is 50–60%. Thus, for the Finnish national economy,

1,000 it is vitally important to secure smooth maritime transports in all

circumstances. During 2021, passenger traffic was particularly low, and

800 the State’s support measures continued to be necessary, for example, in

600 order to ensure the transports of foods and medicines.

400

200 The International Maritime Organization (IMO) has set a target

to reduce maritime greenhouse gas emissions by 50 per cent by the

0 year 2050. The demands of maritime customers as related to the

2017 environmental-friendliness of shipping have also increased. Deployment

of new technologies and significant new investments are necessary in

Other investments order to achieve the set goals. Success requires collaboration within the

Capital funds entire maritime cluster, which is a larger employer than, for example, the

Equities forest industry. New funding models are also needed to safeguard the

Infrastructure and forest competitiveness of Finnish navigation.

Real estate

Credit funds and loans Development of the Earnings-

Bonds Related Pension System

Money market instruments

Since the reforms in 2016, the seafarers’ pension system has been quite

Investment income similar to the earnings-related pension scheme in general. The pension

Return on capital employed, % reforms implemented at the start of 2017 were applicable to the system

governed by the Seafarer’s Pensions Act (MEL) as well. For old-age

2021 2020 2019 2018 2017 pension, the lowest pensionable age rose in 2021 by three months so that

16.2 6.2 10.7 0.7 8.1 those born in 1957 could retire with old-age pension at the age of 63 years

and 9 months. Within the seafarers’ pension system, the possibility to

Average annual return, % retire at a lower individual old-age pensionable age under MEL remains

1 y 5 y 10 y 15 y 20 y valid until the end of 2024.

16.2 8.3 8.3 6.3 6.6

The life expectancy coefficient confirmed for the year 2021 was 0.94984,

Average real return, % and accordingly, the commencing pensions were cut by approximately 5.1%.

5 y 10 y

7.0 7.2 The role of the Seafarers’ Pension Fund as the field-specific pension

provider has remained unchanged, and its development is linked with the

development of Finnish navigation.

In recent years, the earnings-related pension system has become more

centralised, and as a result, there are currently four pension companies

in Finland. During 2021, the investigation into whether the municipal

pension scheme could be merged with the private-sector pension scheme

was completed. The end result was that they will not be merged.

In 2021, a survey was initiated concerning the shared vision and goals

for the pension decision process and estimate calculation for the earnings-

related pension sector. Established sub-goals include common needs for

technological upgrading and the development of services. From the start

of 2022, the pension calculations of the Fund’s new pension system rely

on the common calculation software utilised in the pension industry.

This software enables for all pension calculations to be more efficient and

resources to be allocated more to customer services.

The survivors’ pension reform entered into force at the beginning

of 2022. This reform brings changes to both the spouse’s and orphan’s

6