Page 12 - Seafarers---_Pension_Fund_Annual_Report_2021

P. 12

Annual Report of the Board Technical Provisions

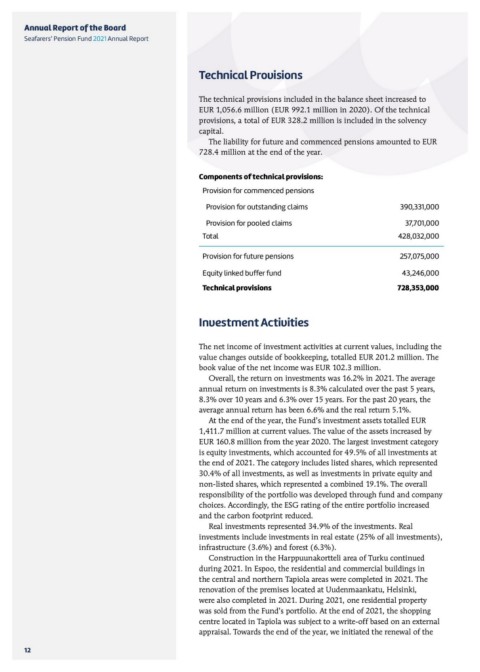

Seafarers’ Pension Fund 2021 Annual Report The technical provisions included in the balance sheet increased to

EUR 1,056.6 million (EUR 992.1 million in 2020). Of the technical

12 provisions, a total of EUR 328.2 million is included in the solvency

capital.

The liability for future and commenced pensions amounted to EUR

728.4 million at the end of the year.

Components of technical provisions: 390,331,000

Provision for commenced pensions 37,701,000

Provision for outstanding claims

Provision for pooled claims 428,032,000

Total

257,075,000

Provision for future pensions 43,246,000

Equity linked buffer fund 728,353,000

Technical provisions

Investment Activities

The net income of investment activities at current values, including the

value changes outside of bookkeeping, totalled EUR 201.2 million. The

book value of the net income was EUR 102.3 million.

Overall, the return on investments was 16.2% in 2021. The average

annual return on investments is 8.3% calculated over the past 5 years,

8.3% over 10 years and 6.3% over 15 years. For the past 20 years, the

average annual return has been 6.6% and the real return 5.1%.

At the end of the year, the Fund’s investment assets totalled EUR

1,411.7 million at current values. The value of the assets increased by

EUR 160.8 million from the year 2020. The largest investment category

is equity investments, which accounted for 49.5% of all investments at

the end of 2021. The category includes listed shares, which represented

30.4% of all investments, as well as investments in private equity and

non-listed shares, which represented a combined 19.1%. The overall

responsibility of the portfolio was developed through fund and company

choices. Accordingly, the ESG rating of the entire portfolio increased

and the carbon footprint reduced.

Real investments represented 34.9% of the investments. Real

investments include investments in real estate (25% of all investments),

infrastructure (3.6%) and forest (6.3%).

Construction in the Harppuunakortteli area of Turku continued

during 2021. In Espoo, the residential and commercial buildings in

the central and northern Tapiola areas were completed in 2021. The

renovation of the premises located at Uudenmaankatu, Helsinki,

were also completed in 2021. During 2021, one residential property

was sold from the Fund’s portfolio. At the end of 2021, the shopping

centre located in Tapiola was subject to a write-off based on an external

appraisal. Towards the end of the year, we initiated the renewal of the